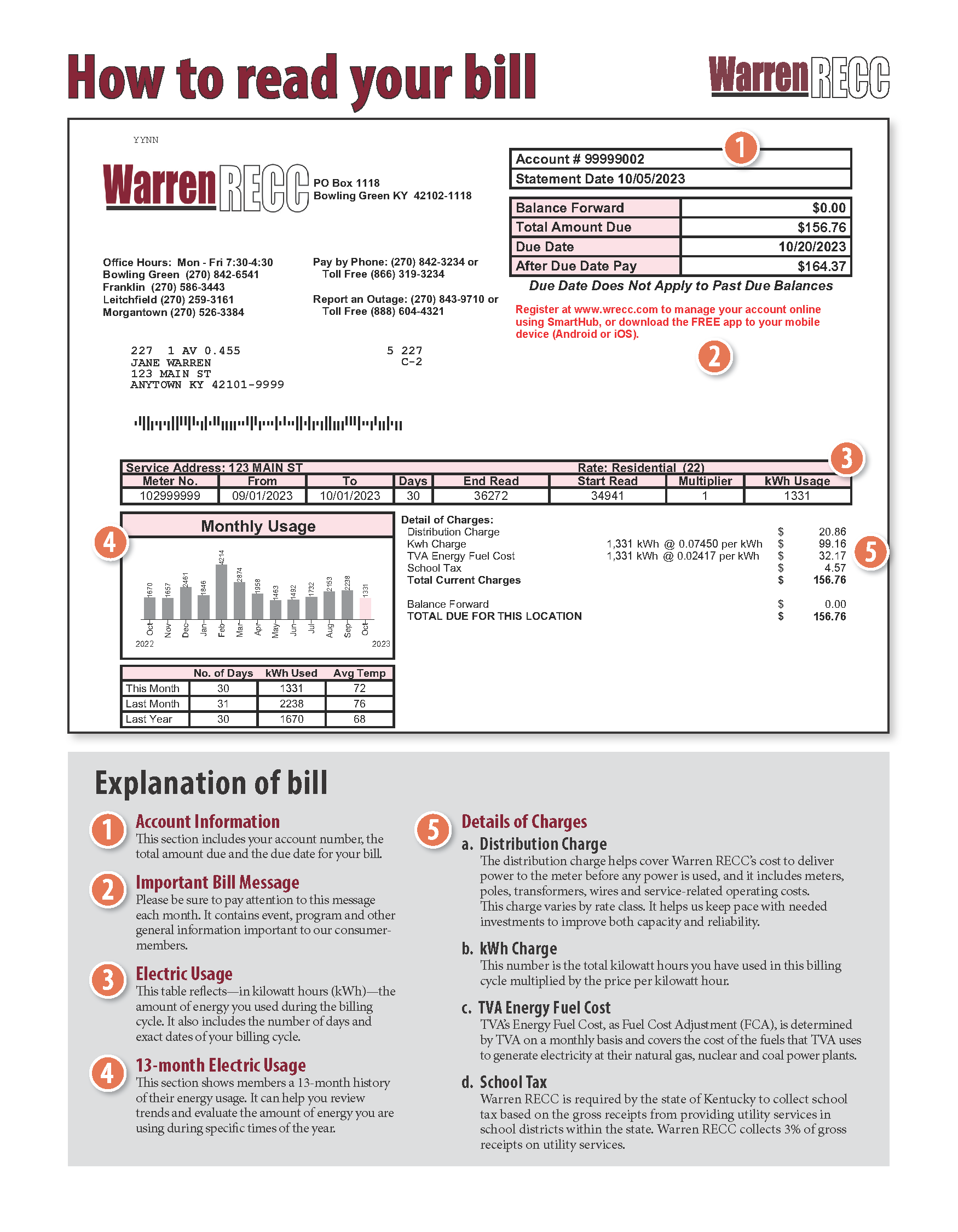

Add 3% school tax

| Distribution Charge: | $23.86 per month |

| Energy Charge: | |

| Summer (June thru September) | $0.08005 per kWh |

| Winter (December thru March) | $0.07665 per kWh |

| Transitional months (October, November, April & May) | $0.07450 per kWh |

FAQ

What is TVA energy fuel cost?

TVA Energy Fuel Cost refers to the cost of the fuel- the uranium, coal, and natural gas- that TVA must purchase in order to generate your electricity. It is a per kilowatt hour charge, and is determined on a monthly basis by TVA. For more information, visit tva.com/Energy/Our-Power-System.

For the month of April 2024, the rate for residential members is $0.02270 per kilowatt hour used.

- 1,000 kWh at $0.02270 = $22.70

- 1,400 kWh at $0.02270 = $31.78

- 2,500 kWh at $0.02270 = $56.75

You have control. By lowering your consumption you can reduce the amount of your electric bill and the fuel cost. Here are some energy-efficiency tips.

Increased usage can be because more heating is required due to colder temperatures, you use more hot water, or cook more during holidays. Knowing What Uses Watts can help you control electric usage. Read more…

What are Member Charges?

Member charges are based on the Cooperative’s cost of providing certain services to individual members. Members using these services pay for them so rates may be kept low for other members who do not need these special services. Other charges may be applicable in special situations. Deposits and charges are subject to change.

What is the Per Kilowatt Hour (kWh) rate for the SRS?

The per kWh rate on SRS accounts is the same as the rate currently charged on those meters – the General Service 1 rate (GSA1). However, because residential rates are currently not subject to state sales tax, those eligible for the SRS will see a sales tax savings due to the reclassification.

What is the Supplemental Residential rate?

Warren RECC offers a Supplemental Residential Rate. This newly approved rate allows you to save money if you have an additional meter at the same location as your home and that additional meter is not used for business purposes. Examples include a detached garage, an electric fence, or a storage/tool shed.

How Can I Apply for the Supplemental Residential Rate (SRS)?

If you believe you may be eligible, please contact Warren RECC at 270-842-6541.

What qualifies for the SRS rate?

Some common types of services that qualify for the SRS Rate are:

- Detached garage

- Personal shop

- Electric gate/fence

- Pool house/pool pump

- Storage/tool shed

- Well pump

What does not qualify for the SRS rate?

Some common types of services that do not qualify for the SRS rate are:

- Temporary service

- Services on a property separate from the single-family dwelling

- Commercial business

- Church

- Barn used in a commercial farming operation

The above list is not comprehensive, but is meant to highlight some common types of services that do not qualify for the SRS.

Does the Shop Across the Road From My House Qualify for the SRS?

A personal shop will qualify for the SRS as long as it is on the same parcel of property as the residential dwelling. If the shop and house are on the same property – even if it’s separated by a road – then the shop will qualify. If, however, the shop is on another parcel of property, it will not be eligible for the SRS.

I Have a Garage On a Piece of Property But No House, Does it Qualify for the SRS?

No, the purpose of the SRS is that it pertains to meters that are supplemental to the residence, or part of the residence in some way. A garage or storage building on a piece of property without a house is classified under the General Service 1 (or GSA 1) rate. In order to comply with TVA’s requirements for the SRS, applications on a separate property from your home must remain in the GSA rate.